Making the Business Case for Digital Records Management in the Insurance Industry

Businesses across industries are recognizing the need to work toward digital maturity. Those that have reached this state are generally using robotic process automation, artificial intelligence, and machine learning routinely throughout their businesses.

Though it's typically been leery of adopting new technologies, the insurance industry has begun making moves toward digital transformation as well. Insurers, with their vast quantities of paperwork and frequent customer interaction, are among those that stand to gain tremendously from moving "up the information management value chain," in the words of the State of the IIM Industry report.

Below, we discuss the top three reasons for the insurance industry to accelerate it's digital transformation and digitize its records management.

Digital Maturity Enhances Security

The customers of insurance companies must entrust their personal, private information to insurers, and they expect it to be kept safe. Furthermore, the government expects the same, requiring insurance companies to take appropriate steps to safeguard the personal information of their clients.

At Ripcord, data security comes first. Whether your company's data gets scanned in by our proprietary robots or was digital from its start, it’s safe in our document management platform, Canopy. Each client has its own secure, private cloud-based instance, accessible only to those who have been granted credentialed access. Our data is encrypted, so there’s no need to worry about private data being visible to anyone who shouldn’t see it. To any would-be interlopers, the content is completely inaccessible.

In addition to being encrypted and safe from hackers, digitized, classified, cloud-based information is not subject to the risks of flood, fire, or warehouse break-ins that can destroy paper files. No one can simply forget where they put a document if it's been digitized, nor can they lose it and have it fall into the wrong hands. When it's in Ripcord's cloud-based Canopy platform, it's safe.

Digital Maturity Yields Long-Term Cost Savings

Digitizing paper documents saves money upfront by reducing the need for physical storage space, reducing the number of employees needed to maintain physical records, and reducing equipment costs related to physical storage.

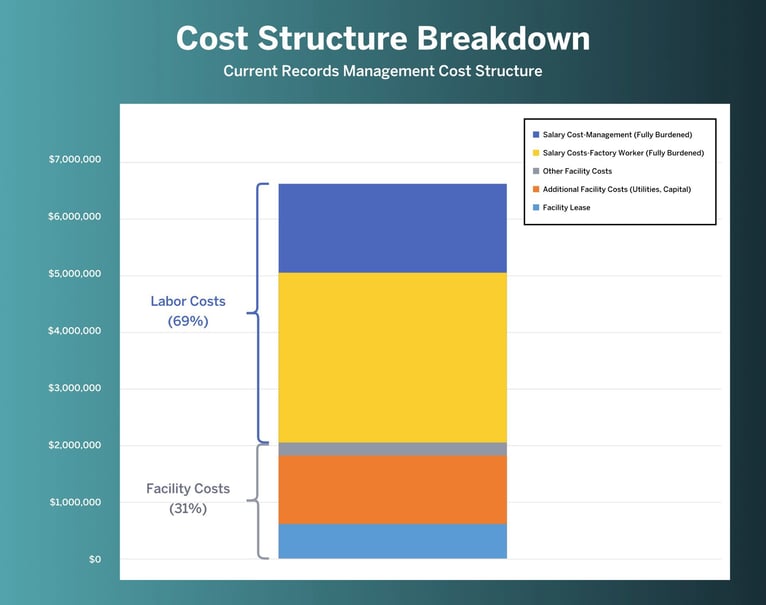

For example, one large insurer is spending upward of $6 million each year just on physical record maintenance. This includes high monthly storage facility rental costs, salaries for 50 full-time workers whose jobs center solely on the warehouses, forklifts and other heavy machinery, and more.

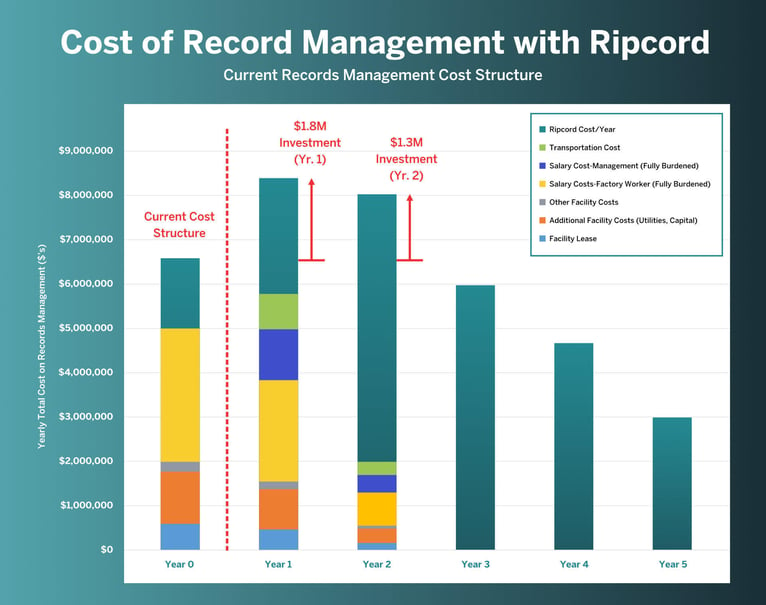

By engaging with Ripcord and moving its data to Canopy, the company would save millions of dollars within the next few years.

Digital Maturity Facilitates Better Customer Service

In today's work, people are constantly spending time online to complete personal and professional work. They want answers and responses quickly.

For insurance companies, this means kicking customer servicing into high gear. What better way to get a more superior customer experience than with better digital tools? For example, faster, smoother, next-generation chatbots capable of accessing and dispensing needed, tailored information at any time of day or night can save an insurance company customer hours of worry sifting through paper documents and/or making multiple phone calls that may or may not eventually lead to a human being. After all, a single positive customer experience can pay major dividends.

Make the most out of accessing, indexing, and organizing your data to drive insights and provide better customer experiences across the business.

Digitally Transform Your Insurance Services

Ready to accelerate your digital transformation within the insurance space? Ripcord can help. Get in touch with our team to start turning your documents into powerful data and improved customer experiences.

/Ripcord%20Logo%20-%20Color%2011.png?width=2000&height=620&name=Ripcord%20Logo%20-%20Color%2011.png)