The Future of Work: How Loan Origination Services Reach Digital Maturity

Recent events such as the COVID-19 pandemic have led to significant upheaval in the global economy. Financial uncertainty and widespread unemployment have caused changes in retirement balances, changes in consumer spending habits, and more.

On the other hand, some changes have been financially favorable. For instance, the Federal Reserve’s recent interest rate slashes have resulted in a spike in refinance applications by home and automobile owners looking to save much-needed cash on their monthly bills. As mortgage rates drop to near-record lows, total loan applications continue to rise, as do the number of auto refinance loan applications.

With lenders at capacity and many lenders working remotely due to the social distancing protocols that have accompanied the pandemic, loan origination services everywhere are sorely in need of a boost. However, lenders that are well on their way to digital maturity are already in better shape than their paper-bound counterparts.

This eBook explores the digital transformation occurring in loan origination services and examines how those lenders yet to get fully on the digital bandwagon can still benefit by starting their transformation today.

Digital Transformation Is Long Overdue

Regarding the need for digital transformation in consumer lending, PwC noted the following:

“The majority of consumers now prefer to apply for loans online, especially young borrowers. While some segments still prefer human interactions for certain parts of the process, a viable digital process is now mandatory for lenders wishing to compete across all consumer segments.”

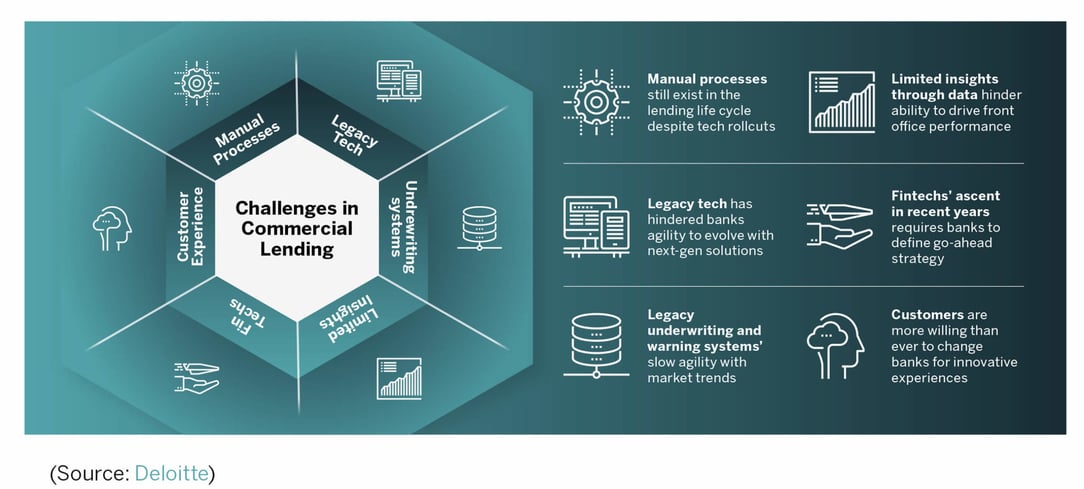

Though that observation was made as far back as 2015, loan origination services have not, for the most part, reached digital maturity in many organizations. That’s a problem. Why? Deloitte notes:

“The digital revolution of the 21st century is reshaping the customer relationship with the banks. People of all ages are now connected 24/7 to their financial data, and Millennials, the internet-born generation, require new services to satisfy their requirements in terms of customer experience.”

In the past, a lack of competition meant that, in the area of digital transformation, traditional lenders could sit on their laurels and continue to maximize profits using outmoded, non-customer-friendly methods. Given the entry onto the lending scene of new, agile, more technology-friendly players, lenders may now find themselves in a harried game of catch-up as they try to retain their share of the market.

Another recent Deloitte report highlights that consumers now expect a seamless digital experience in lending, much like the digital experience they enjoy with leading technology brands such as Apple, Amazon, and Google. These technology brands have managed to form an emotional connection with consumers, a process that has been largely lacking in loan origination services of the past. The report notes:

“If banks want to keep up, they have to engineer the digital experience [these technology brands] offer to make these emotional connections, which, ultimately, could translate into ... more profitable customers.”

The same holds true in the commercial lending space. Deloitte estimates that as much as 30 to 40 percent of lenders’ time is actually spent on manual tasks in disaggregated systems that could be automated with investment in digitization tech.

Lenders that rely on manual, paper-intensive underwriting processes prolong the loan origination process and likely lose customers in the process.

By leveraging Ripcord’s digital loan origination services, lenders can move toward digital maturity and begin forging better connections with both personal and commercial clients by upping customer satisfaction. This begins with the automation of many of the manual tasks (such as data entry and customer account setup) that overworked lending institution employees do now. This move saves valuable time for lenders and eliminates some of the tasks human workers report liking least, thereby increasing worker happiness as well.

Meeting the Challenge of Compliance

It’s not just consumers who are concerned about traditional lenders’ apparent lag in the adoption of digital solutions for loan origination services. The 2019 Regulatory & Risk Management Indicator reveals that 47 percent of lenders identify their top concern as their institution’s reliance on manual rather than automated compliance processes. At the same time, 46 percent report that their institution plans little to no investment in compliance automation in the next year.

With this state of affairs, it’s no wonder that lenders fear falling behind on compliance issues.

The laws governing the practice of lending are both onerous and growing all the time. Being out of step with just one federal, state, or local regulation can cost a lender huge sums, and trying to keep up manually can mean hours of eye-straining, stultifying work for employees.

Ripcord’s document management solution enables lenders to automate their documentation processes, but it also does much more. Enhanced with AI and machine learning technology, the system ‘learns’ and gets smarter the more data is entered into it. This capability enables lenders to do things such as identify unique borrower characteristics and behavior patterns. This can aid in the rooting out of non-compliant attributes, such as those associated with money laundering and other illicit activities (for which a lender can be held accountable).

Ripcord’s solution also supports first-line quality control, which is another area that, when left to mistake-prone humans, is rife with the potential for non-compliance. Digitization and automation mean eliminating the possibility of human error that could result in additional costs in the form of fines and lost customers. Canopy can also understand, analyze, and classify unstructured files, the sort contained in audio and video clips.

Enabling Seamless Service Integration

Many lenders have already taken the step of lightening their workloads by having ‘back-office’ functions such as loan-fulfillment services performed by outside providers. When using Ripcord’s solution for loan origination services, there’s no need to stop using this sort of time-saving support. Our solutions seamlessly integrate to connect with loan-fulfillment services, giving lenders better, more transparent control over the information in their databases.

Facilitating Better, Faster Lender Decision Making

Digitizing the application and underwriting processes means that customers and potential customers get answers sooner. It also means the logic that got the lender to those answers is sounder, and the lender decisions are less risk-prone.

Just 19 percent of banks offering digital loan origination also offer instant credit decisions, according to a recent survey done by the American Bankers Association. That’s likely because traditional lending has typically involved mounds of paper documents and the time and resources of multiple levels of personnel, making speed a stranger to the process. With digitization and automation, lenders can receive, review, and act upon documentation quickly.

With Ripcord’s solutions, lenders can do away with the time-consuming, cost-prohibitive burden of handling paper documents without worrying about putting customer information at risk. A robust document management solution such as Ripcord facilitates faster, more efficient decision-making.

Document security is inherent in Ripcord’s loan origination solutions. Canopy is a highly secure, cloud-based platform that stores each client’s data in the client’s own, secure instance. Only credentialed users may gain access, and the data is encrypted to thwart any would-be hackers. Tighter security and a more streamlined, less cluttered process mean faster turnaround time for loans.

Giving Customers the Power to Choose Wisely and Act Quickly

It isn’t just lenders themselves that want faster decision-making processes. HBR research reveals that customers also prefer a simplified approach in the pre-purchase stage. The research notes that customers choosing between two companies gravitate “dramatically” toward the one that “simplifies decision-making by offering trustworthy information tailored to the consumer’s individual needs.” Companies that “focus on simplifying consumers’ decision making will rise above the din, and their customers will stick by them as a result.”

Artificial intelligence in Ripcord’s loan origination services means that lenders can offer bespoke suggestions to customers, streamlining the process by which those customers come to their decisions and making them feel confident in the moves they have made.

Increasingly, too, customers both want and expect to be able to sign documents digitally (and have legal weight given to those signatures). Yet fewer than half the digitally savvy banks surveyed in the ABA poll report allow for electronic loan agreement signatures. With a secure digital solution, more lenders would likely be able to offer e-signature capabilities in addition to online loan applications, resulting in more timely decisions for borrowers and safer bets for lenders.

Improving Customer Experience

No longer are we living in a time when the average consumer wants in-person, up-close, chit-chat-heavy experiences at the companies with which they do business. As we head toward the third decade of the 21st century, the name of the game is convenience (with a middle name of speed). People want to do things for themselves so they can control when, where, and how quickly the tasks on their to-do lists get done. That includes loan applications. In one recent survey, 73% of respondents reported preferring self-service technologies over having to engage with a business employee. By employing Ripcord’s loan origination solutions, lenders can put borrowers back where they want to be: in the driver’s seat.

Deepen Contextual Awareness

Ripcord’s artificial intelligence and machine learning capabilities mean that lenders can achieve deep contextual awareness for their data. In the loan process, banks and other lending institutions are dealing with complex documentation and vast amounts of unstructured data.

The more frequently a lender puts such material into Ripcord’s platform, the better able the platform is to be contextually aware, and so predict and analyze data patterns. This contextual awareness and the insights it produces can result in reduced client-acquisition costs, lower client attrition, and increased client satisfaction.

In lending, as in many fields, there are numerous types of content for both the company and the client to handle. There is also a wide variety when it comes to information structures of different loan types. As part of its contextual awareness capability, Ripcord’s loan origination solution makes sense of all of this data and enables instant searchability for all your digitized documents.

Achieving Digital Maturity with Digitized Document Management

Ripcord’s document management platform, Canopy, is in a unique position to help. Lending has historically been paper-reliant, with agreements, regulatory documentation, and more requiring the retention of vast reams of documents, even long after forms have been signed and borrowers have been making steady payments for years. With Canopy, all these documents can still be stored, just without all the room paper documentation required.

Companies expect the amount of data they will be tasked with handling to more than quadruple in the next two years, according to the State of the IIM Industry 2020 report. With paper, the long-term storage of which is already unworkable for even mid-sized entities, the keeping of old documentation would be almost impossible in the face of such increases. Canopy, on the other hand, will scale with an organization, so no matter how large the organization grows, its smart, cloud-based storage, search, and indexing system will grow with it.

Canopy is an intuitive, end-to-end digitization solution. It enables users to locate specific, granular information from among thousands of files, all with sub-second searches. It allows for the easy management, creation, sharing, and editing of documentation. Perhaps most important in these uncertain times, in the long run, it will save an organization considerable time and money.

Back to You

Ripcord is on a mission to digitize the world, one industry at a time. Using our vision-guided robots, AI, and machine learning technology, we digitize, enrich, and organize an organization’s most important paper documentation, no matter how much of it there is.

Our cloud software, Canopy, enables the instantaneous classification, indexing, search, and retrieval of every part of an entity’s scanned documentation, both structured and unstructured. Ripcord saves organizations time and money and frees up human employees for more of the higher-level work they truly enjoy.

To get all of the insights from our research, make sure you download a copy of the full eBook below.

/Ripcord%20Logo%20-%20Color%2011.png?width=2000&height=620&name=Ripcord%20Logo%20-%20Color%2011.png)